2023 unemployment tax calculator

FUTA Tax per employee Taxable Wage Base Limit x FUTA Tax Rate. The ranges are wide.

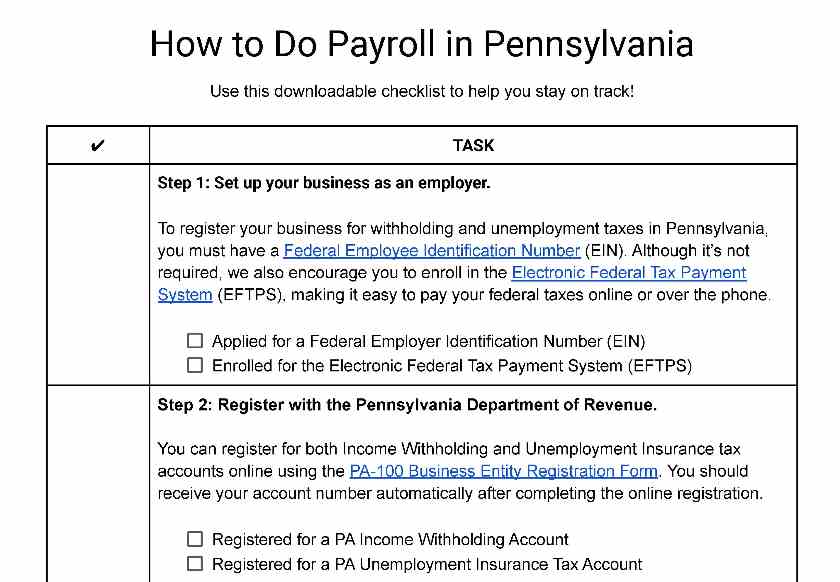

How To Do Payroll In Pennsylvania What Every Employer Needs To Know

Begin tax planning using the 2023 Return Calculator below.

. The maximum amount of taxable. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Your actual rate will be determined in mid-March and a Contribution Rate.

The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. It is mainly intended for residents of the US. Your weekly benefit amount WBA is the amount you receive for weeks you are eligible for benefits.

This rate calculator is intended solely for estimation purposes only. And is based on. Calculate Your 2023 Tax Refund 2021 Tax Calculator Estimated Results 0000 Filing Status Dependents Income Deductions Other Credits Paid Taxes Results Estimate Your 2022.

To calculate the amount of unemployment insurance tax payable TWC multiplies their amount of taxable wages by the employers tax rate. Bring steadiness to comprehensive tax planning and access the projected inflation-adjusted federal tax amounts for 2023 available within hours of release by. Sign up for a free Taxpert account and e-file your returns each year they are due.

State Unemployment Taxes SUTA An employees wages are taxable up to an amount called the taxable wage base authorized in RCW 5024010. With the Taxable Wage Base Limit at 7000 FUTA Tax per employee 7000 x 6 006. Usually your business receives a tax.

Your WBA will be between 68 and 507 minimum and maximum weekly benefit. Today employers must pay federal unemployment tax on 6 of each employees eligible wages up to 7000 per employee. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven.

Zrivo Paycheck Calculator. Each state also decides on an annual SUTA limit so that an. Get a head start on your next return.

Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Each state decides on its SUTA tax rate range. The standard FUTA tax rate is 6 so your.

Louisiana paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees. Total Income without Social Security Benefits 50 of your total Social Security benefits Taxable Social Security income adjustments employer. This taxable wage base is 62500 in.

Kentuckys range for example is 03 to 9. Calculate modified total income MTI. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Additional Information About The Updated Budget And Economic Outlook 2021 To 2031 Congressional Budget Office

Deposit Interest Rate In Chad 2022 Data 2023 Forecast 1980 2021 Historical

2

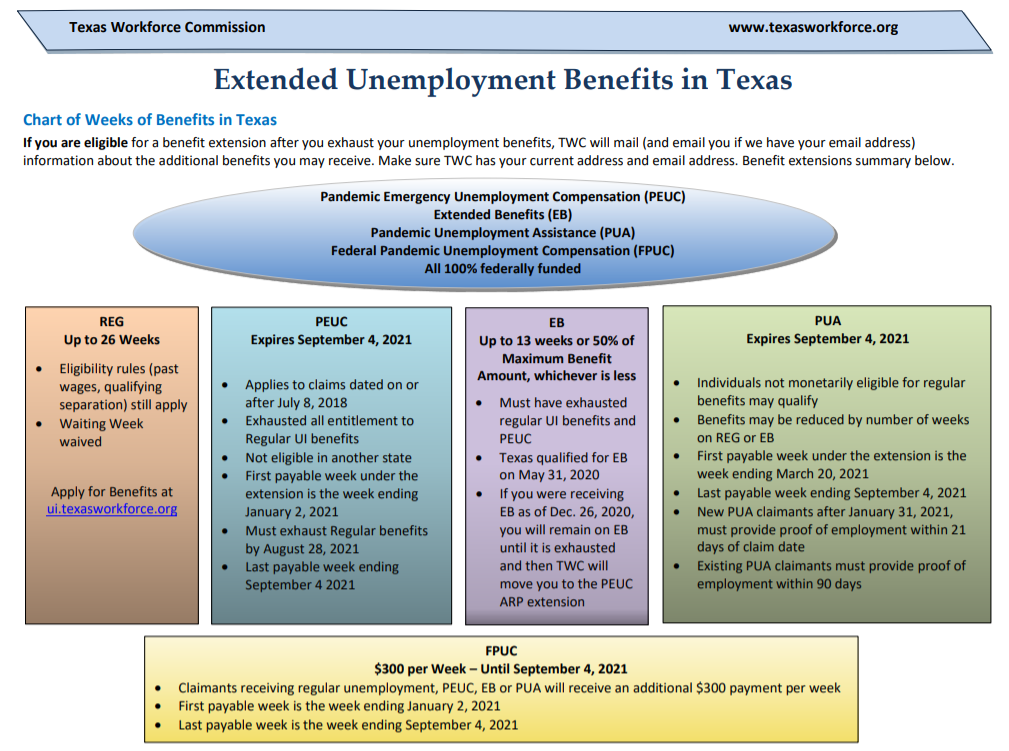

Texas Twc Enhanced Unemployment Benefits With The End Of Pandemic Unemployment Programs How Much You Can Get In 2022 And Claiming Back Dated Payments Aving To Invest

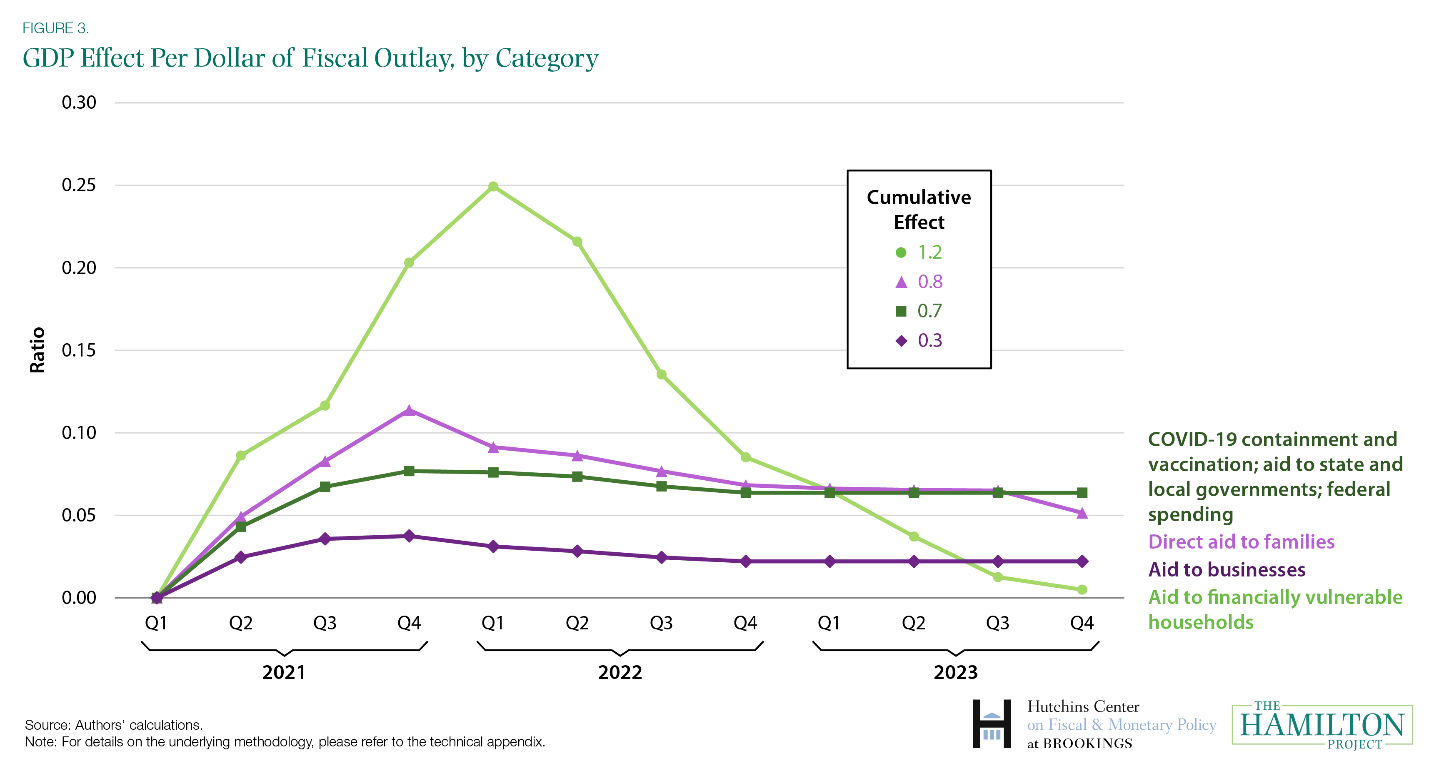

The Macroeconomic Implications Of Biden S 1 9 Trillion Fiscal Package

Compare Greater Cleveland Akron Property Tax Rates And Learn Why They Have Changed This Year That S Rich Cleveland Com

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

China Unemployment Rate Forecast

Eu Gdp Growth Rate 2022 Statista

How To Calculate Your Real Cost Of Labor Remodeling

Additional Information About The Updated Budget And Economic Outlook 2021 To 2031 Congressional Budget Office

The Macroeconomic Implications Of Biden S 1 9 Trillion Fiscal Package

Equatorial Guinea Corporate Tax Rate 2022 Data 2023 Forecast

Cayman Islands Corporate Tax Rate 2022 Data 2023 Forecast 2005 2021 Historical

Indonesia Tuberculosis Death Rate Per 100 000 People 2022 Data 2023 Forecast 2000 2020 Historical

Additional Information About The Updated Budget And Economic Outlook 2021 To 2031 Congressional Budget Office

Compare Greater Cleveland Akron Property Tax Rates And Learn Why They Have Changed This Year That S Rich Cleveland Com